In rural India, seamless online payments are often challenging. Limited internet connectivity, unreliable electricity, and the unfamiliarity with digital tools posed significant challenges. Transactions often require cumbersome cash-on-delivery systems or dependence on physical bank branches, inconvenient and time-consuming for both consumers and merchants. This digital divide not only hampered financial inclusion but also limited economic participation and the potential for growth in rural communities.

Recognizing this hurdle, the National Payments Corporation of India (NPCI) introduced UPI Lite X, a revolutionary feature enabling seamless offline payments through the familiar UPI platform. UPI Lite X represents a variation of UPI Lite, employing Near Field Communication (NFC) technology for the transfer of funds between two devices. This implies that transactions occur directly between on-device wallets rather than bank accounts. It’s incredibly straightforward – no internet connection is required on either the sender’s or recipient’s phone. This ingenious solution addresses the growing need for convenient and accessible transactions, particularly for low-value payments like everyday purchases under Rs. 500.

In this article, we’ll explore four ways in which UPI Lite X’s offline capability is driving financial innovation and expansion, and how it can help businesses and individuals alike.

1. Expanding Horizons: Increased Accessibility

Contrary to popular belief, digital payment solutions haven’t been universally accessible. There are certain rural regions where connectivity may be unstable or unreliable. According to recent data from the Economic Survey, over 65% of the country’s population resides in rural areas, where internet connectivity can be erratic. Here’s where UPI Lite X steps in as a game-changer, ensuring financial transactions reach the remotest corners, fostering inclusion and bridging the digital divide. The concept of UPI Lite X aligns perfectly with the prevalent trend of low-value payments in rural regions. With a considerable volume of transactions involving amounts less than Rs. 200, UPI Lite X is tailored to cater to the specific needs of rural users who engage in numerous smaller-value payments. This has opened up new opportunities for individuals and businesses in remote areas, who previously had limited access to digital payment solutions.

2. Improved Efficiency & Enhanced Security

The introduction of UPI Lite X has ushered in a new era of improved efficiency and heightened security in the realm of digital payments. The significant reduction in transaction failures has not only streamlined the overall digital payment experience but has also paved the way for innovative optimizations within UPI Lite X. However, the upper limit is set as ₹500 for both LITE X offline and UPI LITE online transactions to ensure seamless and secure low-value transactions. The maximum limit for adding funds to your UPI Lite wallet is ₹2,000, providing users with flexibility and control over their digital transactions.

The offline capability of UPI Lite X functions as a strategic tool for optimizing processing resources, mitigating transaction failures, and elevating the efficiency of digital payment solutions. Beyond providing a seamless experience for users, this advancement benefits banks as well. Instead of inundating the Core Banking System (CBS) with individual transactions, UPI Lite X intelligently groups them for later settlement. This intelligent bundling not only ensures a smoother and faster process but also frees up real-time processing capacity for critical financial operations and larger transactions.

Moreover, UPI Lite X prioritizes security in the ever-evolving digital payment landscape. Leveraging Near Field Communication (NFC) technology, UPI Lite X establishes a secure and reliable communication channel between devices. This strategic integration of NFC technology acts as a robust deterrent against fraud and cyber-attacks, ensuring that users can engage in digital transactions with confidence and peace of mind.

In this innovative stride towards efficiency and security, UPI Lite X introduces specific criteria for its offline capability:

- Mutual UPI Lite X Offline Enablement: Both the payer and the payee must have UPI Lite enabled in offline mode to engage in transactions, reinforcing a secure and standardized process.

- Utilization of Existing UPI Lite Wallet: UPI Lite X smartly utilizes the existing UPI Lite wallet for offline transactions, capitalizing on the familiarity and convenience of users’ preferred payment method.

- Seamless Debit and Credit Transactions: Transactions involving UPI Lite X offline mode follow a straightforward process—debiting the payer’s UPI Lite X account and crediting the payee’s UPI Lite X account. This ensures a seamless and efficient exchange of funds.

As UPI Lite X continues to redefine the digital payments landscape, its commitment to enhanced efficiency, security, and user-friendly innovations positions it as a frontrunner in the financial technology revolution. Embracing UPI Lite X is not just a step towards a more streamlined payment experience; it’s a leap into a future where efficiency and security harmonize seamlessly in the world of digital transactions.

3. Optimizing User Experience:

UPI Lite X stands out as a beacon of user convenience. The platform introduces features that not only simplify but enhance the overall digital payment experience, making it a preferred choice for users seeking seamless, secure, and efficient transactions. Upping the ante in user convenience, UPI Lite X introduces a ₹500 upper limit for both offline and online transactions. This deliberate cap ensures that users can engage in lower-value transactions seamlessly, catering to everyday needs without compromising on security or efficiency.

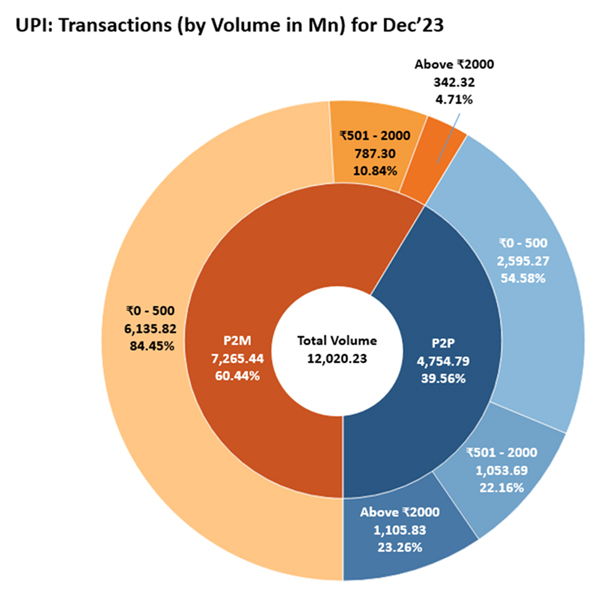

Strategically implementing the ₹500 upper limit not only enhances user convenience but also significantly reduces the load on banks’ Core Banking Systems (CBS). According to recent data from NPCI, Transactions under 500 formed 84% of P2M transactions while they formed nearly 55% of P2P transactions. Based on current data analysis and projections, it is estimated that about 60% of future digital payment transactions will be below INR 200.This optimized load benefits both users and financial institutions, contributing to a harmonious and resource-efficient transaction environment. The strategic capping ensures that transactions, especially those of lower value, flow smoothly, enhancing the overall efficiency of the banking system.

4. Catalyzing Business Growth:

As UPI Lite X takes center stage in catalyzing business growth, it unfolds a myriad of benefits tailored for customers, banks, and merchants, marking a paradigm shift in the digital payments landscape.

UPI Lite and Lite X Benefits for Customers

- Faster and Seamless Payment Experience: UPI Lite streamlines low-ticket-size transactions (up to INR 500), ensuring swift and hassle-free payments. Whether it’s purchasing groceries, settling utility bills, or splitting expenses with friends, the platform ensures a swift and hassle-free payment journey, empowering users in their day-to-day financial transactions.

- Reduced Clutter in Bank Statements: Elevating user convenience, UPI Lite brings forth cleaner and more organized bank statements. The streamlined approach significantly reduces the number of low-value entries, offering customers a clearer financial overview and simplified tracking of their transactions

UPI Lite and Lite X Benefits for Banks:

- Lighter Load on Banking Infrastructure: UPI Lite significantly reduces the load on banking systems. By efficiently handling a substantial volume of small transactions, it minimizes strain on servers and network resources, ensuring a more agile and responsive banking system.

- Higher Success Rates: The simplified framework of UPI Lite translates into heightened success rates for banks. Banks can process payments swiftly, leading to improved customer satisfaction and operational efficiency.

UPI Lite Benefits for Merchants:

- Enhanced Success Rates: Merchants, ranging from street vendors to e-commerce platforms, witness a boost in transaction success rates with UPI Lite X. The platform’s reliability in payment processing fosters a seamless business experience, instilling confidence in both merchants and customers.

- Improved Business Efficiency: By leveraging UPI Lite X, merchants can enhance overall business efficiency. From streamlined payment processes to reduced reliance on cash handling, the platform becomes an integral part of optimizing various operational aspects, including inventory management, accounting, and customer service.

In essence, UPI Lite X emerges as a transformative force, ushering in a new era of efficiency, reliability, and financial empowerment for all stakeholders in the digital payment ecosystem. In conclusion, UPI Lite X is driving financial innovation and expansion in ways that were previously unimaginable. From empowering small businesses to connecting with the remotest communities, UPI Lite X is writing a story of financial inclusion that goes beyond the headlines. As we navigate this transformative era, remember that the heart of innovation beats stronger when it reaches every corner. Connect with Mindgate Solutions, the driving force behind UPI transactions, and become a part of this narrative where financial empowerment knows no boundaries. Your journey towards a digitally connected future begins with a single tap. Are you ready to join the revolution?